Commentary magazine has lost half of its money since becoming independent in 2007

By 2020 it was down to $5.7 million from $11.3 million

Commentary brought in more money than it spent in only 1 of 14 years

The magazine depends on selling off assets to cover deficits—their rapid erosion imperils its continued existence

At recent rates, the magazine will lose the rest of its money in the next eight years

Editor John Podhoretz, who made $396,205 in 2020, is one of the highest-paid non-profit magazine editors in America

Commentary magazine has a problem. It is on a path to insolvency within the next decade, a review of fourteen years of financial disclosures from 2007 to 2020 shows.1

The magazine had $11.3 million when it became independent from its parent organization of sixty-two years, the American Jewish Committee, in January 2007.2 By December 2020, it had only $5.7 million—half of what it began with—or, adjusting for inflation, 39%.3

In thirteen of the intervening fourteen years, Commentary spent more than it brought in from magazine revenues and donations. To cover these shortfalls, Commentary repeatedly liquidated its investments for cash, selling them faster than they gained value in a period of record market performance, eroding its principal.

Commentary managed to reduce its spending by a fifth during this period, but revenues still fell short of covering expenses—by an average of $819,156 in recent years.4 Meanwhile, Commentary continued to pay its staff generously, especially its longtime editor John Podhoretz, whose 2020 compensation was $452,557.

Going by its most recent financials, Commentary will burn through the rest of its money in eight years should something fundamental not change about its spending or ability to bring in money.

An Operating Deficit

Commentary spent an average of $495,631 more than it made in thirteen of fourteen years

Commentary is transparent about the fact that magazine revenues do not cover all its costs. Its fundraising page reads: "like many intellectual magazines, Commentary does not operate at a profit." But this phrasing obscures the fact that even with fundraising, the magazine runs at a steep deficit.

In the past ten years, Commentary has spent an average of $495,631 more than it has made—in the past five, $819,156.5 Were Commentary solely reliant on income from subscriptions and ads, its annual deficits in the same period of time would average $2.4 million.6

In 2020, Commentary's budget was $2.9 million. In the same year, Commentary brought in $2.3 million: $755,007 from subscriptions and advertisements, $1.3 million from donations (and a PPP loan), and $222,126 in profits from stock sales and dividends.7 The $653,083 gap between revenue and expenses constitutes Commentary's 2020 operating deficit.

In thirteen of the fourteen years between 2007 and 2020, Commentary recorded operating deficits ranging from $6,142 to $997,320, averaging $599,588. Investment gains meant that Commentary’s funds grew in three years of operating deficits.

Revenues

Commentary’s ability to bring in money determines what it can sustainably spend. Its income has generally ranged from $2.1 million to $3.0 million. In the past five years—which have included Commentary’s four lowest years of revenue—it has averaged $2.3 million. Unfortunately, these amounts are rarely enough to cover the cost of the magazine’s operations.

Commentary Magazine

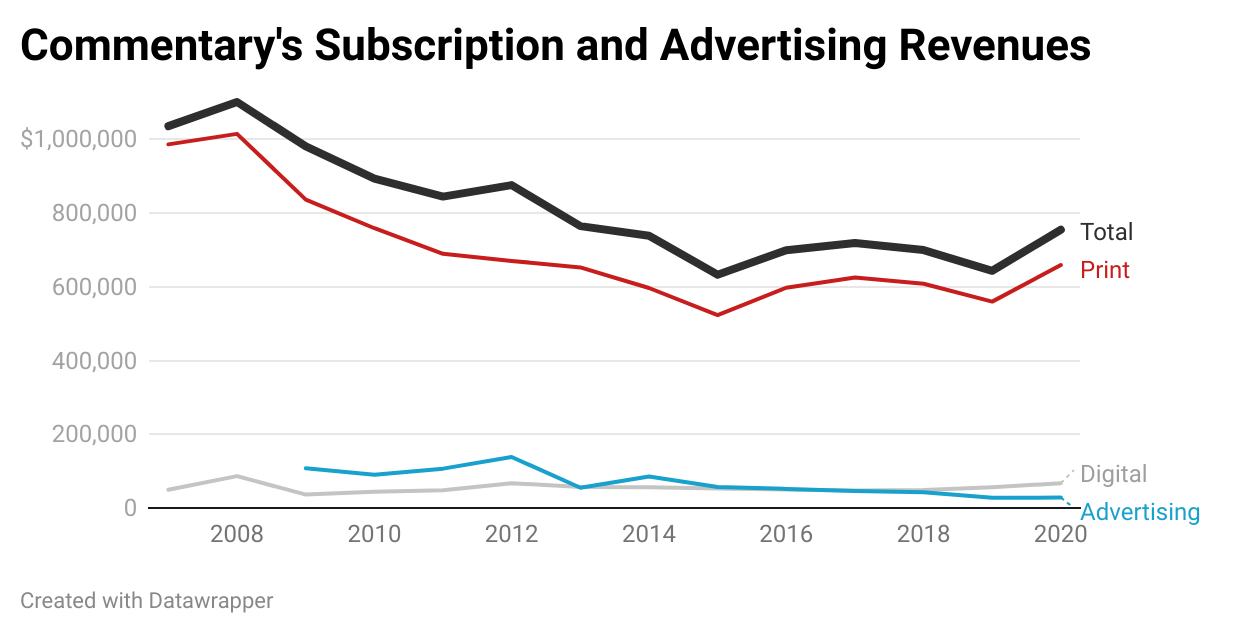

Only about a third of Commentary’s income in recent years has come from Commentary magazine itself. Since a drop in 2013, magazine revenues have oscillated between $633,170 and $764,876, averaging $706,764, covering 23% of the magazine’s costs.

Most magazine revenue (94%) comes from subscriptions, with advertising making up the remainder.8 The number of subscribers has remained virtually the same since Commentary became independent. The magazine reported that it had 26,000 subscribers in 2020, only a slight dip from 27,000 in 2007.

In spite of similar circulation numbers, revenue from Commentary’s magazine and website has markedly decreased. As of 2020, it was 69% of its 2008 peak of $1.1 million.9

Because such a small part of Commentary’s budget is covered by the income from Commentary magazine, the health of the magazine’s balances in a given year largely hinges upon donations.

Donors

A majority of the money coming into Commentary comes from contributions, but donations vary widely from year to year—by as much as $1.6 million in the instance of 2013 to 2014.

Since 2013, fundraising has ranged from $1.1 million to $2.8 million, averaging $1.6 million, and has covered an average of 52% of expenses.

Commentary initiated a capital campaign in 2014 that bolstered its routine fundraising. The bulk of the $1.6 million it brought in was raised in the first two years of the campaign. Specifically, the $889,766 raised in 2014 in connection with the campaign made it the only year in which Commentary has recorded an operating surplus.

Investments

The rest of Commentary’s revenue (roughly an eighth) comes from its investments. It both collects investment income (dividends/interest) and sells some of its investments, counting the realized gains (i.e. profit over what was initially paid for the sold assets) as income. In 2020, realized gains were $140,256 and investment income was $81,870.

How Commentary Spends It

Overall expenses are down, but the cost of staff has markedly increased

Commentary’s 2020 expenses were down 24% from their 2007 levels. Among the most significant reductions were what Commentary spent on printing (down 74% or $564,955 from what it spent in 2007) and what it paid outside contributors (down 41% or $190,310 from what it spent in 2007).

Commentary’s payroll expenses grew markedly in the same period, however. By 2020, the total cost of staff salaries had increased by 20% and the total cost of benefits and payroll taxes had increased by 40% from their 2007 levels, meaning on net Commentary spent 24% or $362,823 more on these expenses and they represented a much larger part of the magazine’s overall budget.

A Well-Paid Editor

John Podhoretz made $396,205 in 2020 and is among the highest-paid non-profit magazine leaders in the nation

The single largest line item Commentary reports is the compensation of its editor John Podhoretz. In 2020 his salary was $396,205 and total compensation was $452,557, about 16% of the magazine’s budget.

According to the magazine’s non-profit filings, Commentary’s executive committee determines Podhoretz’s compensation looking at "comparable salaries based on a recognized study" and other organizations' non-profit filings.10

As the table below shows, looking at peer magazines in 2019, the latest year from which disclosures are available from all non-profits, Podhoretz’s salary was not stratospheric, but still was the highest among the group.

It is not a purely apples to apples comparison. For instance, several of the organizations are think tanks that pay their publications’ editors-in-chief less than their executives. However, you can observe that Commentary is the only money-losing organization that pays its executive so well.

Whether a non-profit magazine is money losing often has less to do with its business acumen and circulation than it does the existence of one or two patron donors contributing enough to make it whole most years; Commentary just seems to not have one.

It should also be said that Podhoretz is not given an automatic raise every year. In fact, in 2020, he took a twenty-eight thousand dollar pay cut. More dramatically, in 2014, his salary was sliced by 30% to $298,702. It is unclear what events precisely precipitated these cuts. It is possible that the fact that 2014 ended up being a banner fundraising year led to Podhoretz’s salary being restored at a higher level.

Selling Investments: How Commentary Covers Deficits

Liquidating investments to cover deficits has cut into investment principle and prevented Commentary’s funds from accruing value

At the end of 2020, Commentary had $5.8 million dollars in investments, about a quarter ($1.8 million) of which were invested in the stock market. These funds, which in 2020 represented 94% of Commentary’s assets, are crucial to the magazine because they generate income and can be sold to cover costs.11

Acquisitions

Between 2007 and 2009, Commentary acquired $2.9 million in investments, growing its initial $6.7 million in investments to $9.0 million. But since then, the only year in which it has added to its investments was 2014, following the initiation of its capital campaign, when it put another $0.1 million into investments.

Returns

The investments have made modest returns, averaging 2.7% between 2007 and 2020. As a point of comparison, the S&P 500 grew by an average of 8.8% during the same period, which is partly attributable to the fact that only a third of the holdings are in stocks or equity mutual funds.

Sales for Cash

To offset an otherwise negative balance sheet, in ten of fourteen years, Commentary sold some of its investments for cash. In 2020, for instance, facing a $793,339 gap between revenues and expenses,12 Commentary sold 14.4% of the investment assets it had at the start of the year for $923,521 in cash.

There is nothing intrinsically wrong with Commentary’s practice of selling investments. In fact, there would be little point in having such holdings were they not drawn upon. However, the consequence of the size of the sales is that in ten of fourteen years they have exceeded investment gains. For instance, Commentary reported that its investments gained $350,978 in value in 2020 but sold $931,481 of them, leading its December investment balance to be $580,503 lower than its January balance.

After the first three years of acquisitions, Commentary’s investments gained a total of $3.6 million in value, but the magazine sold a net $6.9 million of investments, a reduction of $3.3 million. Today, as a consequence, the magazine’s total investments are worth less than they were (not even accounting for inflation) before Commentary set about buying $2.9 million of them.

A Trend of Decline

Commentary lost half the money it started with in fourteen years. Even when the magazine took in a large amount of cash in 2014, it burned through its windfall and returned to its 2013 level of funds within three years.

Looking at the totals of Commentary’s assets over time allows us to estimate the rates at which they have declined. Using these estimated rates, we can forecast when Commentary may become insolvent. Depending on the years upon which we base our analysis, the projections are more or less bleak.

Looking solely at the five most recent years of data that are available yields the most dire forecast of when Commentary will run out of funds. Specifically, we can project that the magazine will have its last year of positive balances eight years from now in 2030.13

It might be more reasonable to assume that Commentary’s fundraising is cyclic and that a better base period is 2014-2020, which includes the 2014 capital campaign. In this case, the projected last year of positive balance would be twelve years from now in 2033.14

Lastly, looking at the entirety of the fourteen years of data suggests that Commentary has seventeen years until insolvency.15

These are admittedly simplified forecasts, but they represent reasonable estimates based on past data. Were one to attempt a more complex model, one might try to anticipate the implications of inflation on Commentary’s costs, contemplate whether the organization will continue to rent office space at the tune of $220,000 a year when its lease expires in 2024 in an era of increased remote work. One might also attempt to use market futures in combination with Commentary’s asset mix to anticipate how those too might change in value.

The Future

In a self-congratulatory 2020 conversation with his father that he published in Commentary, John Podhoretz explained that the magazine has survived because it “is so defiantly itself that there are a sufficient number of people who not only subscribe to it but believe it is important enough that they provide eleemosynary support for it.” (Eleemosynary is a word that means charitable.) Podhoretz went on to add that but for its unique mission, Commentary would have “become one of those publications that had once existed but existed no longer.”

But Podhoretz’s story is only partly true. Commentary would indeed be completely unviable without its donors, but the $20 million dollars they have poured into the magazine since 2007 have only slowed its fall.

Ultimately, it is unlikely that Commentary will end up dissolving in the next eight years and join its neoconservative peer, The Public Interest, in existing no longer. It is much more likely that instead Commentary magazine may be forced to make some compromises. Since after rent, 70% of the magazine’s budget goes to paying staff, it is likely that savings will come from either cutting salaries or employees.

There is of course a chance that Commentary dodges its money troubles by either significantly growing existing revenue streams or developing new ones. However, a complete reversal seems improbable since the magazine’s audience is somewhat finite. And this audience, which makes up the market of Commentary’s donors and subscribers, has consistently shown it is willing to give Commentary about $500,000 less than Commentary spends. One must wonder why Commentary has not learned to live within its means.

Commentary declined to comment.

Edit: Two charts had small formatting issues, which I fixed

All Commentary IRS Form 990 filings and audits may be found at https://www.charitiesnys.com/RegistrySearch/show_details.jsp?id={17286EA6-6FF3-4457-B9D4-FD23EA9A0D65}. (The 2020 filing was not submitted until November 2021.)

At the announcement of the move, Commentary cited a desire to “court new and larger donors who wish[ed] to fund Commentary directly.” As part of the split, the AJC gave Commentary $6.7 million in investment assets. The newly-independent Commentary was in turn required to raise $3 million and did, after which it received an additional $1 million that the AJC had held in escrow. The $1 million and accumulated interest were fully released to Commentary in 2009, but recorded on its books from 2007 to 2009.

I use the net assets figure throughout since it reflects the current holdings of Commentary instead of total assets, which includes deferred income. The trajectory of the magazine’s total assets is virtually the same ($11.5 million to $6.2 million or a 46% decrease from 2007 to 2020); using total assets numbers yields similar if not more dire projections of insolvency depending on the base period selected.

I use CPI-U numbers for January 2007 (202.416) and December 2020 to make this calculation (260.474).

Excluding investment sales the number is $850,517 .

Commentary also does not put its tax disclosures on its donations website, unlike peers such as National Review, Reason, and Mother Jones,

Prior to the AJC split, Commentary’s fundraising covered its losses, which may explain its optimism about its fundraising potential prior to the break. From 1989 on, the AJC required the magazine to cover its annual deficits through donations. Then editor Norman Podhoretz told the New York Times that the fundraising was “enough to cover operating deficits and provide a small cushion.” Similarly the New York Sun’s coverage of the AJC split described “approximately $1 million Commentary raised last year to account for the gap between its revenue and expenses.”

I have opted to count realized gains towards operating income. If one did not count realized gains, operating losses/gains would average $ 625,556.

Commentary only began reporting advertising revenue in 2009 and appears to have previously folded advertising revenue counts in with print and online revenue. The proportion of subscription revenues calculation comes from the period of 2009-2020.

Were Commentary’s lines of business more diversified, one might argue that since, as is discussed later in the piece, the costs of distribution/circulation have been significantly cut, the cost of magazine revenues has declined. This is true insofar as the marginal cost of an additional subscriber has decreased, but since we must also assume that Commentary’s staff and management work solely towards producing the magazine (although several have other jobs in addition to their full-time work at the magazine), we must also incorporate the costs of their labor and overhead into this calculation.

While it is beyond the scope of this article, it was reported at the time of Podhoretz’s hiring, that "there was no search process" for other editors, which may suggest that there is less need for his salary to be market competitive. Podhoretz’s father, Norman, previously served as editor, which led the hiring decision to be seen as nepotistic.

In fact, since 2018, Commentary’s board has designated the bulk of its assets as part of a “reserve fund” that is “intended to provide an internal source of funds for situations such as a sudden, unexpected increase in expenses, unanticipated loss in funding, or uninsured losses.”

This is the operating deficit ($653,083) less income counted from realized gains ($140,256).

The projected rate of annual losses is $563,507 (95% confidence interval: [−$820,234, −$306,778], SE: 92466, p-value: 0.003, R2: 0.90).

The projected rate of annual losses is $401,719 (95% confidence interval: [−$626,175, −$177,263], SE: 91730, p-value: 0.005, R2: 0.76).

The projected rate of annual losses is $317,428 (95% confidence interval: [−$398,792, −$236,064], SE: 37662, p-value: 1.258*10-6, R2: 0.85).

Pod get paid the big bucks because he knows words like "eleemosynary"

lol

What an informative post. Thanks for the work you put in. It seems that the modified old adage "if you are so rich, why aren't you smart?" could be applied to the funders of such publications. Keep publishing please. Richard